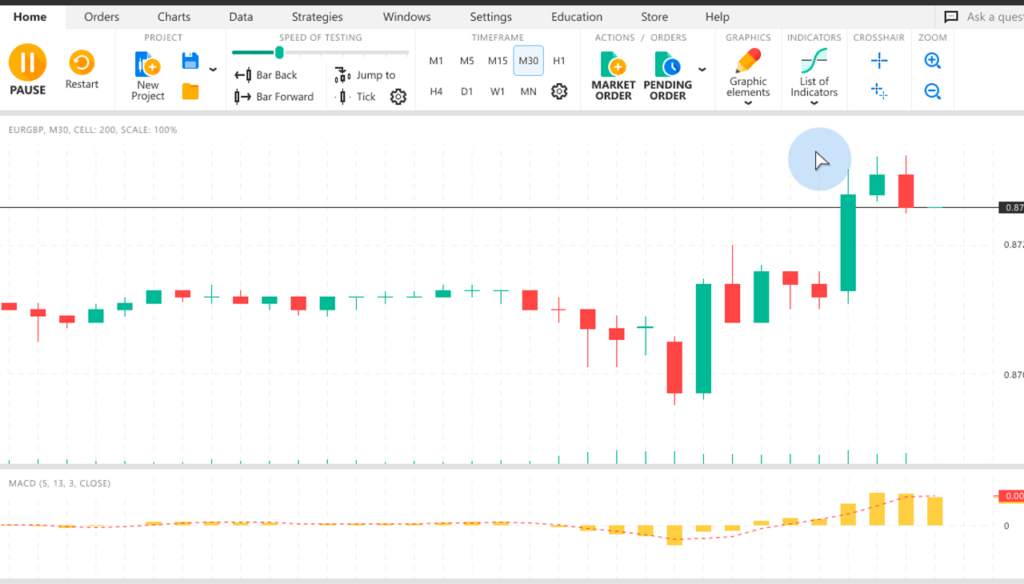

Forex trading can be a daunting task, especially for beginners. That’s where Forex Tester comes in – it’s a software program designed to help traders test and improve their trading strategies in a simulated environment. In this review, we’ll take a closer look at Forex Tester and its features to help you decide if it’s the right tool for you.

Features of Forex Tester

Forex Tester offers a range of features to help traders test and improve their trading strategies:

- Simulated trading environment: Forex Tester provides a simulated trading environment that mimics the real market conditions. This allows traders to practice trading without risking real money.

- Historical data for various currency pairs: The software provides historical data for a wide range of currency pairs, allowing traders to test their strategies in different market conditions.

- Testing of different trading strategies: Traders can test and refine their trading strategies using the software’s backtesting and optimization tools.

- Analysis tools: Forex Tester offers a range of analysis tools, including custom indicators, charting tools, and technical analysis tools, to help traders identify trends and make informed trading decisions.

- Customizable indicators and charting tools: The software allows traders to create custom indicators and charting tools to suit their unique trading strategies.

- Ability to backtest and optimize strategies: Forex Tester allows traders to backtest their strategies using historical data and optimize their strategies for better performance.

Overall, Forex Tester provides a comprehensive set of features to help traders test and improve their trading strategies.

How to use Forex Tester

Here’s a step-by-step guide on how to use Forex Tester:

- Create a testing plan: Before using Forex Tester, it’s important to have a clear plan of what you want to test and achieve. Identify the currency pairs and timeframes you want to test, and what trading strategies you want to apply.

- Choose currency pairs and timeframes: In the software, select the currency pair and timeframe you want to test.

- Run simulations: You can then run simulations of your trading strategies using the historical data provided by Forex Tester. The simulated environment is designed to mimic real market conditions, allowing you to practice trading without risking real money.

- Analyze results: Once the simulation is complete, you can analyze your results using the software’s analysis tools. This will help you identify areas for improvement and refine your trading strategy.

- Refine and optimize your strategy: Based on your analysis, you can refine and optimize your trading strategy. Forex Tester allows you to backtest and optimize your strategy using historical data, giving you the ability to fine-tune your approach before applying it in live trading.

By following these steps, you can use Forex Tester to test and improve your trading strategies in a safe and risk-free environment.

Step-by-step tutorial on how to use Forex Tester

Here’s a more detailed step-by-step tutorial on how to use Forex Tester:

- Install and set up Forex Tester: Download Forex Tester from the official website and install it on your computer. Once installed, open the software and set up your account.

- Create a testing plan: Before you start using Forex Tester, create a plan for what you want to test and achieve. Identify the currency pairs and timeframes you want to test, and what trading strategies you want to apply.

- Select currency pairs and timeframes: In the software, select the currency pair and timeframe you want to test. The software provides historical data for a wide range of currency pairs, so you can choose the ones that are most relevant to your trading strategy.

- Set up testing parameters: Configure the testing parameters, including the starting capital, lot size, and other trading conditions.

- Run simulations: Start the simulation and let the software run through the historical data. You can pause or fast-forward the simulation if you want to focus on specific areas of the data.

- Analyze results: Once the simulation is complete, analyze your results using the software’s analysis tools. This will help you identify areas for improvement and refine your trading strategy.

- Refine and optimize your strategy: Based on your analysis, refine and optimize your trading strategy. Forex Tester allows you to backtest and optimize your strategy using historical data, giving you the ability to fine-tune your approach before applying it in live trading.

- Repeat the process: Test and refine your strategies by running multiple simulations with different parameters, currency pairs, and timeframes.

By following these steps, you can use Forex Tester to test and improve your trading strategies in a safe and risk-free environment.

Common mistakes people make when using Forex Tester

Here are some common mistakes people make when using Forex Tester:

- Not having a clear testing plan: Before using Forex Tester, it’s important to have a clear plan for what you want to test and achieve. Without a clear plan, you may waste time running simulations that don’t provide any meaningful insights.

- Not using enough historical data: To get accurate results, it’s important to use enough historical data when testing your strategies. Forex Tester provides historical data for a wide range of currency pairs, so take advantage of this resource.

- Overfitting strategies: Overfitting occurs when traders optimize their strategies too much based on past historical data. This can lead to poor performance in live trading because the strategy is too specific to past market conditions.

- Choosing the wrong testing parameters: It’s important to choose the right testing parameters, including starting capital, lot size, and other trading conditions. Choosing the wrong parameters can lead to inaccurate results that don’t reflect real-world trading conditions.

- Not analyzing results thoroughly: Once a simulation is complete, it’s important to analyze the results thoroughly to identify areas for improvement. Traders who don’t take the time to analyze their results may miss valuable insights that could improve their trading strategy.

By avoiding these common mistakes, traders can get the most out of Forex Tester and use it to refine their trading strategies for better performance in live trading.

Tips on how to get the most out of Forex Tester

Here are some tips on how to get the most out of Forex Tester:

- Have a clear testing plan: Before using Forex Tester, create a clear plan for what you want to test and achieve. Identify the currency pairs and timeframes you want to test, and what trading strategies you want to apply.

- Use enough historical data: To get accurate results, use enough historical data when testing your strategies. Forex Tester provides historical data for a wide range of currency pairs, so take advantage of this resource.

- Avoid overfitting: Avoid optimizing your strategies too much based on past historical data, as this can lead to poor performance in live trading. Instead, aim for a balanced approach that takes into account current market conditions.

- Test multiple strategies: Try testing multiple trading strategies to see which ones perform best in different market conditions. This will help you identify which strategies work well and which ones need improvement.

- Analyze results thoroughly: Once a simulation is complete, analyze the results thoroughly to identify areas for improvement. Use the software’s analysis tools to identify trends and patterns that could improve your trading strategy.

- Take advantage of customization options: Forex Tester allows you to customize indicators, charting tools, and other features to suit your unique trading style. Take the time to explore these customization options and build a setup that works best for you.

- Practice regularly: Regular practice is key to improving your trading skills. Set aside time each week to practice using Forex Tester and refine your trading strategies.

By following these tips, traders can get the most out of Forex Tester and use it to refine their trading strategies for better performance in live trading.

Leave a Reply